In Lithuania, starting or expanding a business often involves choosing the right legal structure. For both locals and foreign investors, one structure stands out for its flexibility, scalability, and investor confidence: the Akcine Bendrove. This term, translated as joint-stock company, is not just a formality—it’s a powerful foundation for serious business operations, especially for companies looking to scale, attract capital, or go public.

But what is an akcinė bendrovė exactly? Why do some of the most successful Lithuanian enterprises operate under this model? And how does it compare to other business forms in Europe or beyond?

In this in-depth guide, we’ll unpack the structure, legal framework, advantages, challenges, and practical considerations involved in forming and running an akcinė bendrovė in 2025. Whether you’re a Lithuanian entrepreneur, an international investor, or just exploring how this model works, you’re in the right place.

What Is an Akcine Bendrove?

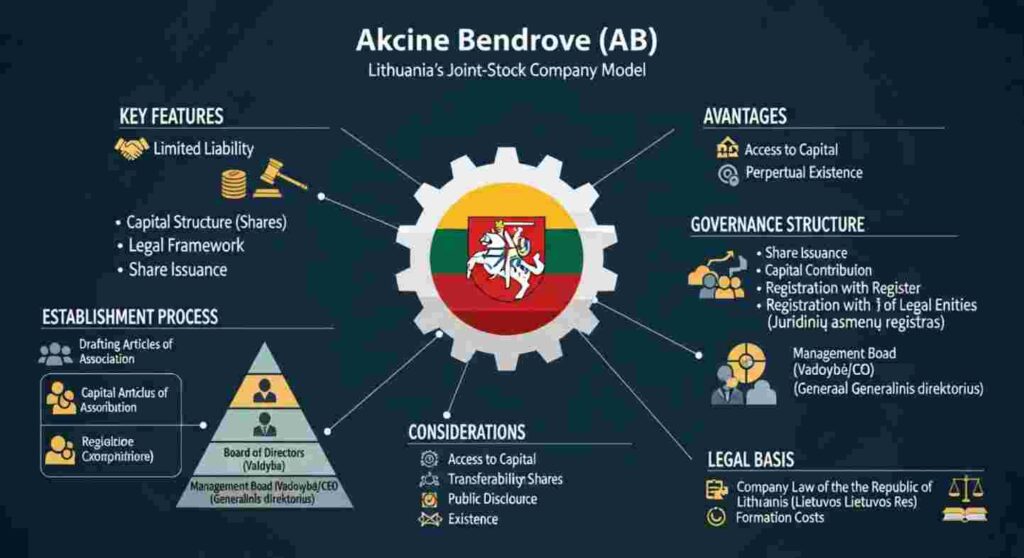

An Akcine Bendrove (AB) is a limited liability joint-stock company that issues shares which can be traded publicly or privately. It’s the go-to structure for medium to large enterprises in Lithuania that intend to raise capital, scale operations, and provide shareholder governance.

Key Characteristics:

-

Legal Entity: Separate from its shareholders

-

Limited Liability: Shareholders are liable only up to the amount of their investment

-

Capital Requirements: Minimum share capital of €40,000

-

Governance: Managed by a supervisory board and a board of directors

-

Share Trading: Shares can be listed on public stock exchanges

This business form is similar to AG (Aktiengesellschaft) in Germany, Société Anonyme (SA) in France, or Public Limited Company (PLC) in the UK.

Why Choose Akcine Bendrove Over Other Forms?

Entrepreneurs in Lithuania typically choose between Uždaroji Akcinė Bendrovė (UAB)—a private limited liability company—and Akcine Bendrove (AB). While UABs are ideal for smaller or family-run businesses, ABs open up a realm of possibilities for growth, investment, and brand legitimacy.

Major Benefits of Akcine Bendrove:

-

Access to Capital Markets

-

An AB can issue shares to the public, making it easier to raise significant capital through IPOs or other securities offerings.

-

-

Higher Credibility

-

ABs are typically held to stricter financial disclosure and governance standards, boosting investor and public trust.

-

-

Attractive to Investors

-

Institutional investors and foreign entities often prefer investing in ABs due to transparency and regulatory oversight.

-

-

Corporate Scalability

-

Designed for larger operations with room for expansion, mergers, or multinational ventures.

-

Legal Requirements to Establish an Akcine Bendrove in Lithuania (2025 Update)

Setting up an akcinė bendrovė requires attention to legal formalities. As of July 2025, here’s what you need:

| Requirement | Details |

|---|---|

| Minimum Share Capital | €40,000 |

| Share Nominal Value | At least €0.29 per share |

| Number of Founders | One or more natural/legal persons |

| Company Name | Must include “Akcinė bendrovė” or “AB” |

| Shareholder Liability | Limited to invested capital |

| Corporate Bodies Required | General Meeting, Board of Directors, and Supervisory Board |

| Registration | With the Lithuanian Centre of Registers (Registrų centras) |

| Articles of Association | Must clearly define operations, structure, capital, and rights |

Structure & Governance: Who Runs an Akcine Bendrove?

The governance model of an AB is more robust compared to simpler company types. This ensures transparency and accountability—especially important for investor confidence.

Governing Bodies:

-

General Meeting of Shareholders

-

The highest decision-making body.

-

Approves financial statements, dividend policies, and board appointments.

-

-

Supervisory Board

-

Optional if the company has fewer than 50 employees.

-

Oversees the Board of Directors and ensures compliance with shareholder decisions.

-

-

Board of Directors

-

Executes day-to-day operations.

-

Appoints and oversees the CEO or Managing Director.

-

-

CEO/Managing Director

-

Implements strategic decisions and manages daily operations.

-

Taxation of Akcine Bendrove in Lithuania

When setting up an AB, understanding the tax implications is essential. Here’s a snapshot of how ABs are taxed in 2025:

Tax Overview:

| Tax Type | Rate (2025) | Notes |

|---|---|---|

| Corporate Income Tax (CIT) | 15% | Standard rate |

| Dividend Tax | 15% | Withholding tax on distributed profits |

| VAT | 21% | Applies if revenue exceeds €45,000 annually |

| Social Security Contributions | Employer pays ~31.18% | Based on employee salaries |

Pro Tip: Lithuania offers tax incentives for startups and R&D-intensive companies, which ABs can leverage if eligible.

Real-World Example: AB “Ignitis Grupė”

A prominent case of a successful Lithuanian akcinė bendrovė is Ignitis Grupė—a leading energy company that went public on the Nasdaq Baltic stock exchange in 2020. Its AB status has enabled international investors to acquire shares, helping the company expand into foreign markets.

This example demonstrates how the AB structure supports transparency, funding, and cross-border scaling.

Common Challenges of Akcine Bendrove

While the akcinė bendrovė model offers considerable benefits, it comes with its own set of challenges:

1. Higher Administrative Costs

-

Legal, auditing, and reporting obligations are stricter compared to UABs.

2. Complex Governance

-

Managing multiple governing bodies can slow down decision-making.

3. Public Disclosure

-

Financial and strategic transparency is mandatory, which may not suit all entrepreneurs.

Akcine Bendrove vs. Uždaroji Akcine Bendrove (UAB)

Here’s a simplified comparison to help understand the key differences:

| Feature | Akcinė Bendrovė (AB) | Uždaroji Akcinė Bendrovė (UAB) |

|---|---|---|

| Share Capital Requirement | €40,000 | €2,500 |

| Share Trading | Public or private | Private only |

| Governance Structure | Complex, multi-tier | Simpler |

| IPO Potential | Yes | No |

| Ideal For | Large or publicly funded firms | Small to medium enterprises |

| Transparency | High (mandatory disclosures) | Moderate |

How to Establish an Akcine Bendrove in 7 Steps

Here’s a streamlined guide for entrepreneurs planning to register an AB in Lithuania:

-

Reserve a Company Name

Verify name availability through Registrų centras. -

Prepare Articles of Association

Outline company structure, operations, capital, and governance. -

Open a Temporary Bank Account

Deposit the minimum share capital. -

Notarize Founding Documents

Must be signed by all shareholders and certified. -

Register with the Centre of Registers

Submit incorporation documents and registration form. -

Receive the Registration Certificate

Your AB becomes a legal entity. -

Register for Taxes and VAT

Complete tax registration through the State Tax Inspectorate.

When Should You Convert a UAB into an AB?

If your UAB is growing rapidly, attracting foreign investment, or considering an IPO, converting to an AB may be a smart move. It signals to stakeholders that the company is serious about transparency, scaling, and investor confidence.

Conclusion: Is Akcine Bendrove Right for You?

For entrepreneurs and investors who envision large-scale growth, transparency, and public investment, the Akcine Bendrove model offers the right mix of legal robustness and financial opportunity. While it demands more compliance and structure, the long-term benefits—in terms of credibility, capital access, and governance—often outweigh the challenges.

Whether you’re establishing a new venture or scaling an existing one, consider your long-term goals. If going public, entering international markets, or attracting serious investors is part of your vision, forming an AB is a forward-thinking decision.

FAQs About Akcine Bendrove

Q1: Can a foreigner set up an Akcine Bendrove in Lithuania?

Yes, foreign individuals and entities can fully own or co-own an AB in Lithuania. There’s no residency requirement for shareholders.

Q2: How long does it take to register an Akcine Bendrove?

The process usually takes 5–10 business days if all documents are prepared correctly and capital is deposited.

Q3: Can I list an AB on a foreign stock exchange?

Yes. Lithuanian ABs can be dual-listed, provided they meet the listing requirements of the foreign exchange.

Q4: Do I need a local director to start an AB?

While there’s no strict requirement for a Lithuanian resident director, having one may simplify regulatory procedures.

Q5: What if my AB fails—am I personally liable?

No. Shareholder liability is limited to the amount of their investment. Personal assets are protected under Lithuanian corporate law.

Q6: What are the annual reporting requirements for an AB?

ABs must file annual financial statements, disclose shareholder meeting minutes, and meet audit requirements based on turnover and employee count.